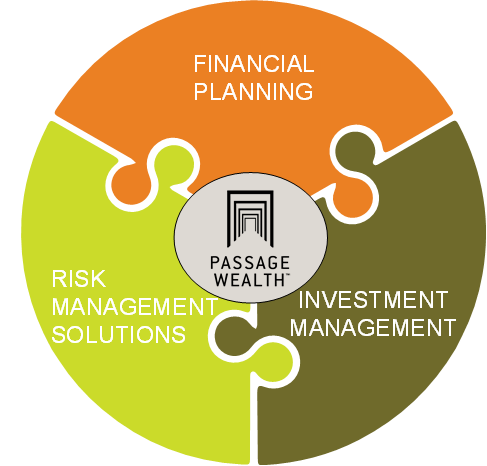

Here at Passage Wealth, we provide 3 different services for engaging with us. However, a majority of our clients find the most value in integrating all 3 services into a comprehensive relationship.

Below you will find a description of these services and the fees for each so you know exactly what to expect when entering into a relationship with Passage Wealth.

Comprehensive Financial Planning & Advice

Everyone is on a different path in their financial journey. We all have different goals, things that are important to us, values we grew up on, and legacies we want to leave behind. As part of having a comprehensive financial plan and ongoing advice, we will take time to get to know one another and build out a financial plan that encompasses all these factors. We will also take time to not only answer questions you currently have, but discuss topics that you may have not thought about or will run into in the future. Since plans are always evolving and new advice is needed, this type of relationship is meant to be ongoing. In the table below you will see an example of different questions clients may ask, topics discussed, and how much that ongoing annual fee would be.

| Your Questions | Topics | Annual Fee |

| · I am saving towards retirement, but not sure if it’s the right amount in the right place. · Do I need life insurance? · My social security statement says I can’t retire until I’m 67 – is that true? · Wills and POA’s are for old people, right? · I would like to save some money to help my kids/grandkids with education | · 401k and other savings strategies · Protection – Life insurance, disability, long-term care · Net Worth, organized by taxable impact; Roth Conversions · Basic Retirement Income Planning (social security and pensions) · Basic Estate planning (beneficiary review, will, POA) · Basic Education Savings (UGMAs, 529s) | $1800 – $2400 Varies by: · Pension and social security options available · Number of Accounts and contracts |

| · I have the same questions, and I also have some special things: – Non-standard pension/social security options – Own a business – Family circumstances or special needs – I want to be generous with charities and others – I’m okay with paying my fair share of taxes, but seems like I’m paying a lot · I am working with an attorney to take care of my parent/ spouse/child · I am the PR for an estate – what do I do with all these forms and account statements? · I just received an inheritance – what should I do with it? Will it impact my taxes? | All of the above plus: · More complex income planning · More complex estate planning · Strategies for addressing family circumstances · Giving plan – during lifetime and at death · Efficiently handling capital gains, taxable distributions · Medicaid Planning, Special Needs Trusts · Settling accounts across various companies and beneficiaries, may include settling into trust accounts · Settling the accounts · Taking distributions in a tax efficient manner | $3000 – $4800 Varies by: · Number/type of income sources · Amount of interaction needed with accountants and attorneys · Complexity of business, family situations · Number and type of accounts · Are trusts involved |

| · I want to transition or sell my business/farm – how do I do that? · I have sold my business – now what? | · Succession plan – Next generation, charity, sell · Complex income, investment, charitable and estate planning | $6000 + |

Investment Management

Fees are based on the aggregate of managed accounts for the household

| Household | Traditional |

| $0 – $250K | 1.50% |

| $250k – $500k | 1.35% |

| $500k – $1m | 1.10% |

| $1m – $3m | 0.90% |

| $3m – $5m | 0.80% |

| $5m – $10m | 0.70% |

| $10m+ | 0.60% |

*Complex cases such as trusts and accounts that require special handling may fall on a higher fee scale.

Risk Management Solutions

We consider solutions from several providers to find the right fit for your needs. The providers pay us a commission. The information provided to you reflects that commission – there are no separate fees. These solutions include:

- Life Insurance: Life is short, and making sure your loved ones are taken care of financially if you were to pass is important. We look at a multitude of different life insurance solutions based on your goals, needs, and phase of life. This includes term insurance, Universal Life, Variable Universal Life, Whole Life, and Indexed Universal Life, among others.

- Disability Insurance: For many, their greatest asset is the ability to have an income. We will review what your current employer offers as far as disability coverage, and help fill in the gap to make sure you and your loved ones have adequate income in case of sickness or physical harm.

- Guaranteed Income Streams: Taking away risk in retirement and building a guaranteed income stream is intriguing to many. We can look at various annuity options including fixed, variable, and deferred annuities to determine a solution for providing this income stream.

- Long-Term Care: The costs for long-term care continue to go up with more and more Americans needing some type of care whether it is home care, assisted living, or a nursing home. We can look at traditional long-term care policies to help pay for those expenses, as well as hybrid long-term care policies that provide greater flexibility than just being used for long-term care needs.